Free Tax Preparation is Possible With VITA

March 30, 2023

For many people, taxes mean stress. It can sometimes take a day – or more – to file taxes, and then there’s the worries that follow. Did you file the right forms? Did you have all the correct documents to file? Did you get all the credits that you were eligible for?

The average American spends eleven hours on their taxes, according to the Internal Revenue Service’s own estimates. Between the time it takes to file, and the worries that may come with it, it’s understandable that we want to hire someone to do our taxes and be done with it. But hiring someone can be an added concern for the elderly, individuals with low income, individuals with disabilities, or people with limited English proficiency. Where do the frustrations end for those who are the most at risk of predatory tax practices?

VITA, which stands for Volunteer Income Tax Assistance, is a free tax preparation and filing services for qualified individuals. It offers free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $60,000 or less

- Persons with disabilities; and

- Limited English-speaking taxpayers

VITA sites are found at nonprofit organizations and staffed by volunteers who are looking for ways to make a difference in their communities. These sites are certified by the IRS and the bottom line is always the same: qualifying taxpayers cannot be charged for VITA services.

Alongside VITA is TCE, Tax Counseling for the Elderly. TCE also offers free tax help, particularly for those who are 60+ years old, and specializes in questions about pensions and retirement-related issues unique to seniors.

Alongside VITA is TCE, Tax Counseling for the Elderly. TCE also offers free tax help, particularly for those who are 60+ years old, and specializes in questions about pensions and retirement-related issues unique to seniors.

Taxes are complex, and many taxpayers don’t realize all the tax credits available; from first-time homebuyers, whether there are children or dependents in the home, or even someone’s marital status, there are many rabbit holes that individuals can get lost in while trying to file taxes. There’s also the Earned Income Credit, which helps low-to-moderate income workers and families get a tax break. It’s estimated that about 20% of individuals who qualify for this credit fail to claim it because they don’t know about it, or don’t know how to claim it.

The VITA program has operated for over 50 years nationwide, and often coincides with workshops for financial help offered by nonprofit partners. At United Way of Greater Milwaukee & Waukesha County, we fund organizations like La Casa de Esperanza in Waukesha and the Social Development Commission in Milwaukee, both of which offer VITA tax preparation services. Funding these organizations helps bring money back to our community, and can also help break the cycle of poverty that our more vulnerable population faces.

While the exact process may be different at different VITA sites, the general process to have your taxes completed with the assistance of a VITA volunteer is easy:

Gather your tax documents (photo ID, social security or taxpayer identification number, wage and earning statements from all employers, etc.).

Gather your tax documents (photo ID, social security or taxpayer identification number, wage and earning statements from all employers, etc.).

- For a full checklist of what to bring, click here.

- Find a VITA site near you. MyFreeTaxes helps people file their federal and state taxes for free, and it’s brought to you by United Way.

- Many VITA sites will schedule an appointment for you to drop off your materials and answer questions about your tax circumstances.

- A VITA volunteer will complete your taxes for you. Some sites allow you to leave and return later once the taxes are complete. Once ready, they will review your return with you and get your signature before filing your return with the IRS.

Taxes don’t have to be difficult, stressful, or expensive. At United Way, we’re looking to better the lives of those who are most vulnerable to predatory tax practices by providing resources that are free to use, with no loopholes. We know that to live better, we must Live United.

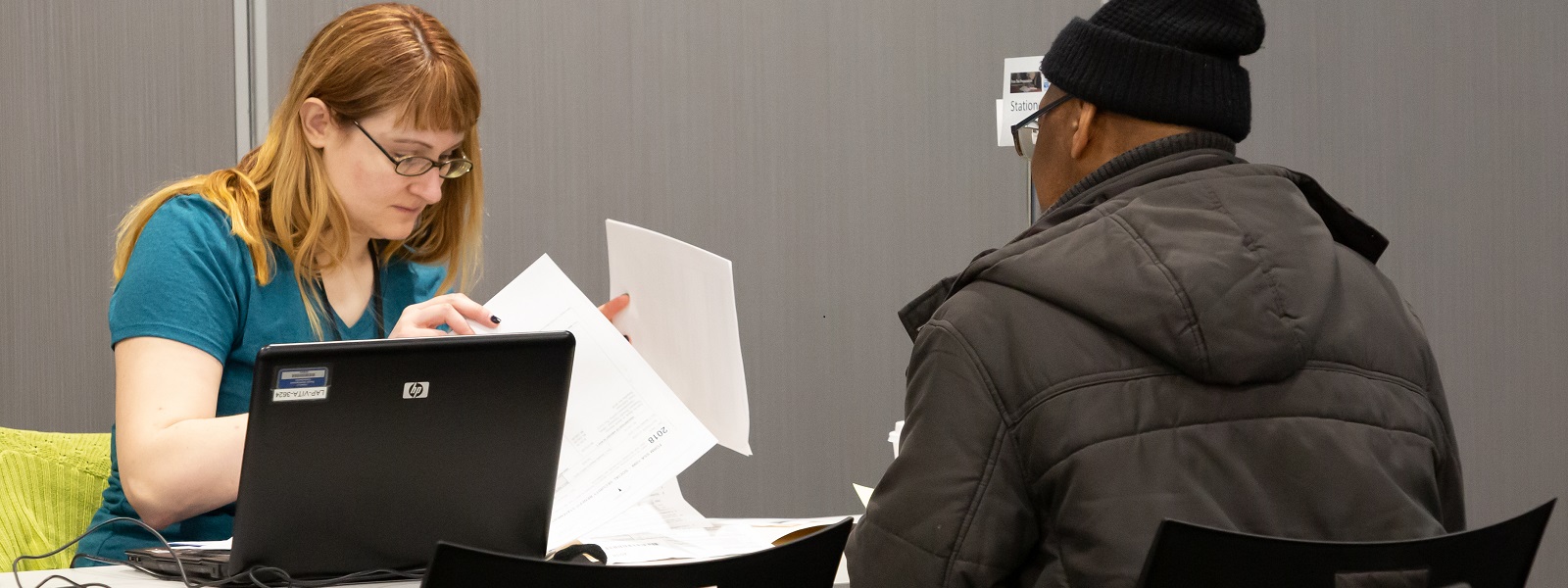

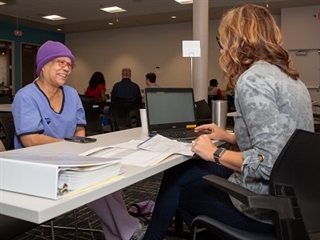

Pictured at top and inline: VITA volunteers help community members file their taxes at our 2019 VITA Super Saturday event.

Interested in supporting Financial Stability?

Click here to donate.

For more updates on our Financial Stability initiative and other United Way initiatives, follow us on Facebook, Twitter, Instagram, and LinkedIN.

Have something to say? LEAVE A COMMENT:

Your email address will not be published. All fields Required.

United Way of Greater Milwaukee & Waukehsa County blog and social media presence is designed as a source for information, sharing and collaboration about United Way and health and human service related topics. As part of our commitment to our readers, we expect all posters to abide by the following rules:

• Posts and comments should be on topic, conversational, and serve to educate or entertain

• Posts and comments may not be unlawful, fraudulent, threatening, libelous, defamatory, discriminatory, harassing, obscene or otherwise rude or in poor taste

• Posts and comments may not be used for any commercial purpose or otherwise to promote any outside organization or its activities

United Way of Greater Milwaukee & Waukesha County reserves the right, at our discretion, to remove any post or to revoke a user’s privilege to post to our page. Comments found to be in conflict with the guidelines above will be removed promptly.

Comments are not necessarily those of United Way of Greater Milwaukee & Waukesha County and its employees and we do not guarantee the accuracy of these posts.